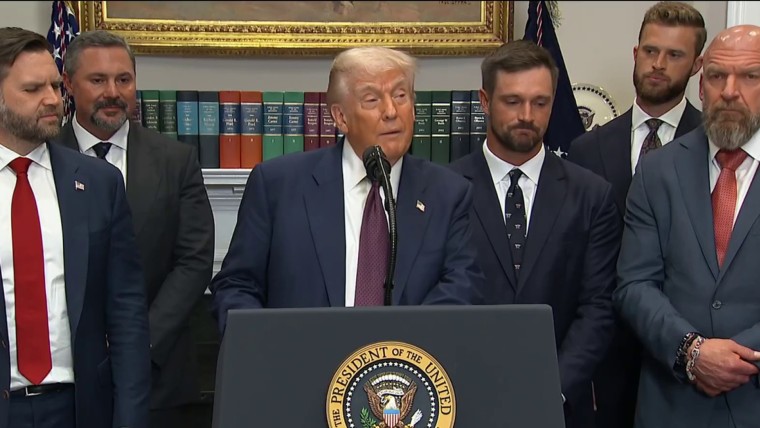

Trump announces new tariffs as stock market dips

Traders bet that the S&P 500, the Dow Jones Industrial Average and the tech-focused Nasdaq would each decline about 1% today over fears that the new import taxes Trump was imposing would cause global economic growth and corporate profits to decline, while possibly reining in inflation. Among the hardest hit were Taiwan, which will now see 20% duties; Canada, whose rate rose from 25% to 35% for goods not covered by the USMCA trade agreement; and Switzerland, at 39%. Much of the rest of the world now faces a 10% baseline rate.

Analysts have calculated that the average effective tariff rate imposed on all goods being imported into the U.S. is now 15%, the highest level since the 1930s.

While today’s market reaction is more muted than the historic sell-off that occurred following Trump’s initial unveiling of country-by-country tariffs in his April “Liberation Day” speech, the cloud of uncertainty over the world economy remains in place as the president has suggested still more tariffs are coming on pharmaceutical products, semiconductors and critical minerals.

“Uncertainty about trade hasn’t gone away,” James Pomeroy, HSBC global economist, said in a note today. He added: “Global trade flows look set to remain choppy in the coming months, making it harder to gauge how both the US and the rest of the world are coping with these elevated import taxes.”